Advanced Transformer neural network with ADX trend detection, trained on 1,700+ days of NQ futures data. 34 engineered features including Kalman filtering and multi-timeframe analysis. Connect your Tradovate account via secure OAuth and receive automated trading signals backed by industrial-grade risk management.

Built for serious traders who demand reliability, security, and performance

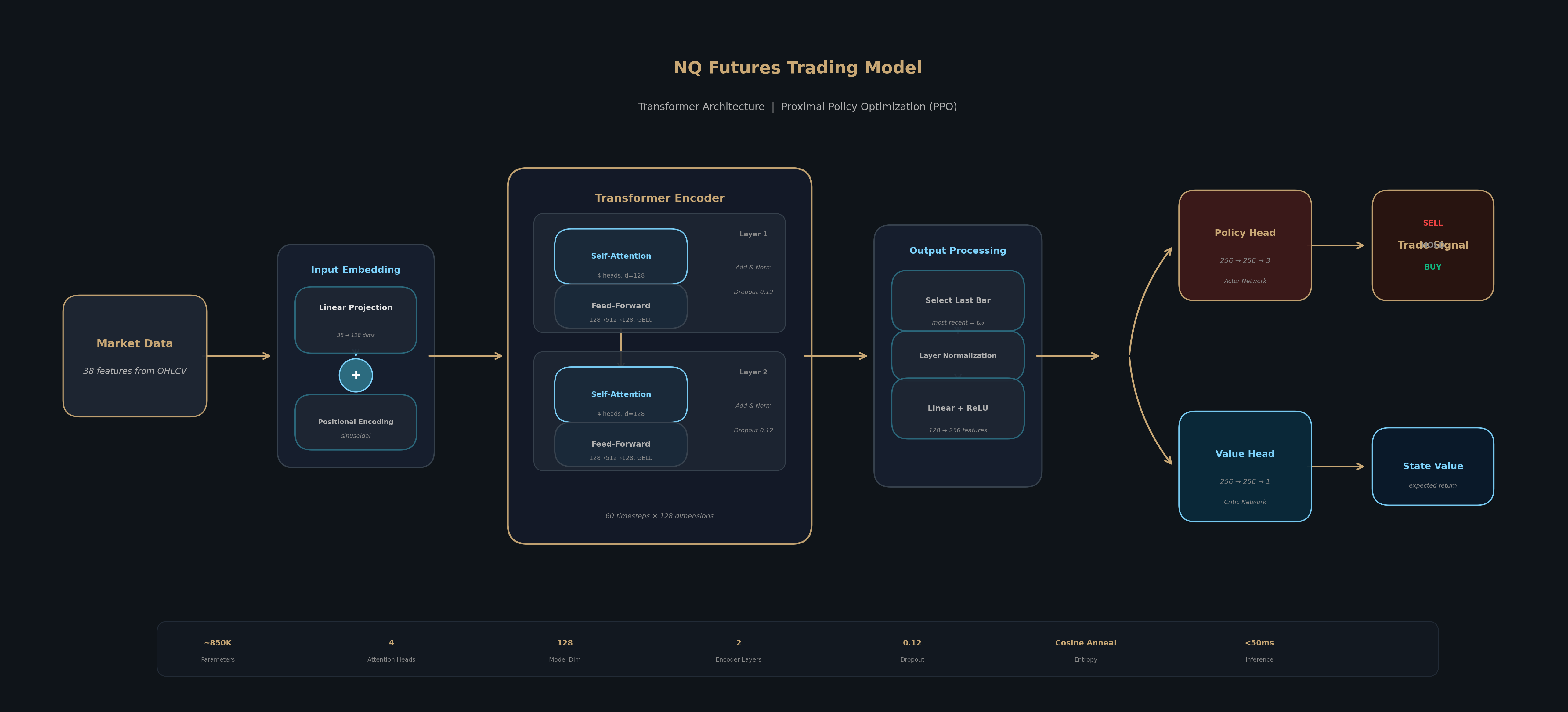

PPO Transformer model with self-attention processes 34 engineered features including ADX trend strength, Kalman filtering, and multi-timeframe analysis. Trained on 1,700+ days of NQ futures data with sub-50ms inference latency analyzing 30-second market bars.

Evaluated on out-of-sample data with robust risk management. Protection system includes hard stop losses (-$400), model-driven exits (no trailing stops), position limits (±1 contract), daily drawdown protection (-$1,500), max hold time (90 min), and trade limits (20/day). Past performance does not guarantee future results.

Secure OAuth 2.0 connection to Tradovate with AES-256 encrypted token storage. Automatic token renewal eliminates re-authentication. One-click connection for both demo and live accounts with instant trading kill switch.

Real-time ML analysis meets automated execution with comprehensive risk protection

Create your account and link your Tradovate brokerage via secure OAuth 2.0. Your credentials are encrypted with AES-256 and tokens auto-renew seamlessly. Choose demo or live environments.

Our Transformer neural network processes live 30-second bars from Databento, analyzing 60 timesteps × 34 features (2,040 data points) to generate BUY, SELL, or HOLD decisions with sub-50ms inference time.

Trading signals are broadcast to all active users. Each order undergoes 8 layers of risk validation (position limits, stop losses, daily limits, trading hours) before automated placement via your OAuth connection.

For traders who want to know what's under the hood

Transformer-based trading model architecture

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

FUTURES TRADING INVOLVES SUBSTANTIAL RISK OF LOSS and is not suitable for all investors. Past performance is not indicative of future results. The high degree of leverage that is often obtainable in futures trading can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

This platform is provided for informational and educational purposes only. All trading signals are generated by algorithmic models that may not perform as expected in live market conditions. You are responsible for your own trading decisions and should only trade with capital you can afford to lose.

By using this service, you acknowledge that you understand the risks involved in futures trading and accept full responsibility for your trading outcomes.